Nowadays, people produce a large amount of data compared to previous decades. We have generated 90% of the world’s data in just the past two years. Businesses, including B2B, leverage such a vast amount of information to receive valuable data-driven insights.

To keep up with competitors can use their digital resource planning (ERP) and customer relationships (CRM) systems to analyze the data about previous and current customers. Then, they can apply such insights in all the stages of the B2B sales funnel, from marketing to calculating customer lifetime value. To achieve this goal, you need to understand what is predictive analytics and how B2B companies can leverage this technique to achieve an increase in revenue.

What is data analytics?

Predictive analytics seems quite simple on the surface – this is a process of analyzing data received from past events to predict outcomes of future events. Still, the process itself is more comprehensive than that. To make accurate predictions, you need to gather relevant data that may vary in size from different sources.

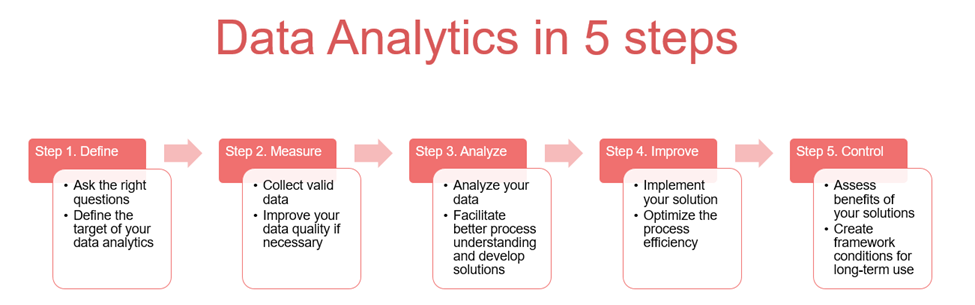

The image below demonstrates the detailed the process of Data Analytics.

In the B2B sector, data analytics required gathering and analyzing Big data from all the previous clients, which required a powerful software.

In the B2B sector, data analytics required gathering and analyzing Big data from all the previous clients, which required a powerful software.

B2B companies can use the following information about their clients:

- Content preferences

- Interactions with certain content

- Use of certain features in the applications

- Search requests

- Browsing activity

- Online purchases

After specialists gathered raw data, they need to analyze it and create a bigger picture of how one or another business can improve business operations. Now, let’s find out how data analytics can improve B2B sales.

Why Does Data Analytics Matter for B2B Sales?

By applying big data analytics, statistical algorithms, and machine learning techniques, B2B businesses can identify the likelihood of future outcomes by considering historical data. The recent research among B2B sales companies showed that among 1000 companies, 53% uses big-data analytics for adding new services, providing better value to their clients, and delivering their services in a better way.

In this way, B2B companies can deliver more flexible and high-quality products. Thus, they can bright more value to their clients.

With this in mind, let us take a look at how data analytics is boosting sales in the B2B sector.

Data analytics in B2B sales: essential use cases

Below we have gathered the main use cases of how B2B companies apply Data analytics to improve their sales funnel.

Improve marketing segmentation

B2B companies leverage Big data in Customer Analytics at the very beginning of sales funnel, i.e., during market segmentation. Since using Big Data, sales managers can make a more clear market segmentation. To create ideal buyer personas for narrower targeted marketing, sales managers gather ERP sales data and undertake data analytics for grouping up existing clients into different target personas. By using ready-made targeting personas, businesses conduct more specific targeted marketing, while reducing inefficiencies.

Effective lead scoring

Data Analytics allows B2B businesses to use historical sales information about previous clients to score new business leads most effectively. To predict which business lead is the most likely to close the deal, companies develop lead-scoring algorithms in combination with external data. Such an approach results in a 30% higher conversion rate for B2B companies across different industries.

Better sales forecasting

One more use case of how Data Analysis in B2B sales can increase revenue is sales forecasting, which is considered to be a procedure is of vital importance. Thanks to precise sales forecasting, a business can smoothly move through the financial year. On the other hand, unclear sales forecasting results in reduced process efficiency, as well as resource allocations.

To create a precise sales forecasting, specialists leverage CRM sale data (customer responses, customer behavior, complaints, sales activities) and autoregressive integrated moving average (ARIMA) algorithm. Thanks to this strategy, businesses receive insights about hidden buying opportunities.

Accurate product recommendation

As a rule, B2B businesses could not show clients a traditional portfolio. For that reason, it might be hard to offer one or another client the most suitable services or products. This fact also results in time-consuming integrations with clients and missed opportunities. In this case, sales managers can leverage Data Analytics algorithms to divide customers into different groups based on their needs. Then, salespeople can compare such customer groups with their previous clients and suggest them more relevant products or services. Also, such an approach, based on the Data Analytics, could identify hidden cross-selling opportunities, thus, increase revenue.

Transparent customer lifetime value

For B2B salespersons, accurate calculation of customer lifetime value is always valuable. Since the company profit correlates with relations with customers and not all sales representatives, know when such relationships might end. To get more precise forecasting of CLV, B2B employees can use Data Analytics, in particular, predictive analytics methods and techniques. In this way, salespersons can calculate for a long one, or another customer will work with the company on the base of one’s profile and data from previous interactions with customers that had fallen into the same group.

Conclusion

Data Analytics is a process of analyzing business information to receive valuable insights. As for B2B companies, this is a useful tool for their income. By using information about previous clients kept in CRM and ERP, B2B businesses can apply clustering analysis, behavioral-based forecasting, and predictive analysis for:

- Developing a marketing persona for each target customer, thus make ads and marketing activities for effective

- Scoring new leads using lead-scoring algorithms based on the interaction with clients from the same target group

- Forecasting revenue based on customers activities and autoregressive integrated moving average, thus achieve more financial stability

- Providing more relevant services and products based on closed deals with similar clients

- Estimating customer lifetime value using predictive analytics methods to retain customers more efficiently.